Internal Vacancy

Senior Assurance Officer Role

We are recruiting for a Senior Assurance Officer to work as part of our Assurance team. The purpose of this role is to provide the company with assurance that our regulatory and operational requirements are working effectively.

Could that be you?...💭

Why not read up a little about what we are looking for from you!

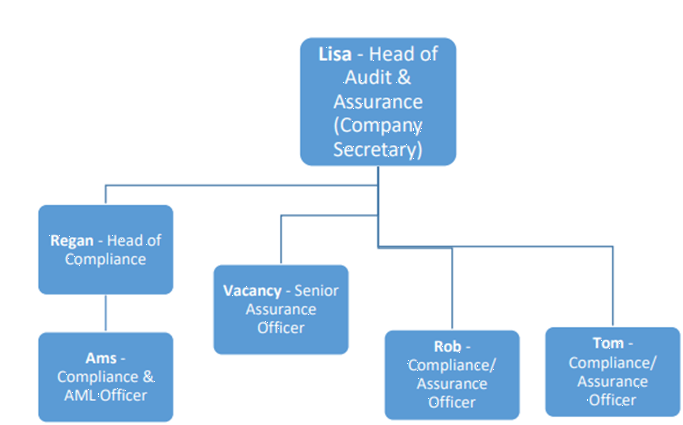

Who will be in your team?

First Response Finance operate a “Three Lines of Defence” governance model.

First Line – this is where each business unit undertakes their own regular monitoring of day-to-day activities. This could be measures, deal reviews or any type of QA.

Second Line – This is our Compliance function (Regan and Amardeep) who provide regulatory advice and support directly to the first line as well as running their own measures and investigations into customer outcomes. Compliance also liaises with the FCA and other outside agencies to make sure we have a “big picture” view of what is happening in the wider industry. Compliance also provide support for our money laundering and PEP queries.

Third Line - The Assurance Team (Rob, Tom, and the Senior Assurance Officer role) are an independent function who provide a robust ‘third line of defence’. This means the team checks and evaluates the adequacy and effectiveness of company systems, and internal control mechanisms to ensure we achieve regulatory and operational requirements to provide good customer outcomes. The team also provide oversight of the first and second lines of defence and report to the Board via the Audit and Risk & Compliance Committees.

What will you do in this role?

- To manage the Agile Assurance Framework, including horizon scanning for emerging risks, administration of the Assurance Backlog along with the identification and prioritisation of assurance reviews.

- Work with the business and Senior Management to evaluate and prepare the scope and testing approach of assurance reviews to ensure they are fit for purpose.

- Facilitation of meetings with key stakeholders and Senior Management

- Conduct 3rd line Assurance testing and monitoring of key controls, along with thematic reviews in accordance with the Agile Assurance Backlog.

- Prepare reports which include presentation of results, the rationale for findings, risks posed, and action required to address the risks.

- Track agreed actions through to conclusion and report on progress upon completion of reviews.

- To manage and perform JSOX testing in line with regulations.

- Assist in the preparation of the firm’s regulatory returns (FCA, FLA etc.).

- Provide regulatory compliance education and training in support of the businesses Learning and Support Team.

- Guide the business to set up and maintain effective ‘first line of defence’ compliance and risk controls.

- Monitor, analyse and report on operational adherence to the organisation’s regulatory compliance and risk control requirements.

- Maintain personal development and associated records indicating achievement of CPD activity & results, including maintenance of knowledge of the regulatory environment.

- Take responsibility for the measures and MI that are relevant to the role and the team, to make any necessary improvements.

- Always support the vision and ethics of the Company, working to its missions, objectives.

- Own the production, measurement, and improvement of customer satisfaction measures.

- Provide support to the R&C and Audit Committees.

Who are we looking for?

- A highly motivated and organised individual with the skills and confidence required to manage the Agile Assurance Framework.

- Has up-to-date knowledge and understanding of regulatory principles and rules.

- Someone who shows great attention to detail, who checks thoroughly, and who has an approach that is in line with putting the customer at the heart of everything we do.

- For you to show ambition, drive and a passionate commitment to being the best in the industry.

- Displays values of openness, integrity and honesty in everything you do.

- A proactive and assertive person with strong problem-solving skills and pragmatic decision making.

- An ability to think strategically, assess risks and explain the potential consequences.

- Ability to challenge the status quo in a constructive manner.

- Good organisation and time management skills, which will allow management of own and others daily workflow to ensure efficiency and strong results.

- An innate ability to receive both positive and learning feedback, and then demonstrate the desire to act on that feedback.

- An excellent written and verbal communicator, with the ability to build effective relationships with key stakeholders. To do this using strong influencing and negotiation skills whilst being able to deal with conflicts positively and objectively.

- Skills and knowledge which would be preferable include:

- Experience of working in a compliance/legal/regulatory change environment.

- Knowledge of CONC, ICOBS, GDPR, AML, SOX and J-SOX.

- ICA/IRM/IIA Qualification or equivalent.

- Experience of working in a compliance/legal/regulatory change environment.

This Opportunity...

This is an opportunity for someone who is looking for a new challenge/ to expand their knowledge of FRFL, our business, and the type of skills we require moving forward.

You can be located at any of our sites to register your interest in this role.

Sound like you?...

If you think you have what it takes to be part of the Assurance team, please register your interest by speaking to Lisa Handley by 5.30pm on Wednesday 9th November 2022.

Already working at First Response Finance?

Let’s recruit together and find your next colleague.